Mortgage rates have stabilized but may decrease before the release of a significant inflation report. The upcoming Consumer Price Index (CPI) report could impact rates, with focus on the core month-over-month number. Mortgage Rates Remain Steady with Potential Decrease Ahead of Inflation Report Mortgage rates have stabilized after reaching their highest levels in over a […]

Category Archives: MORTGAGE

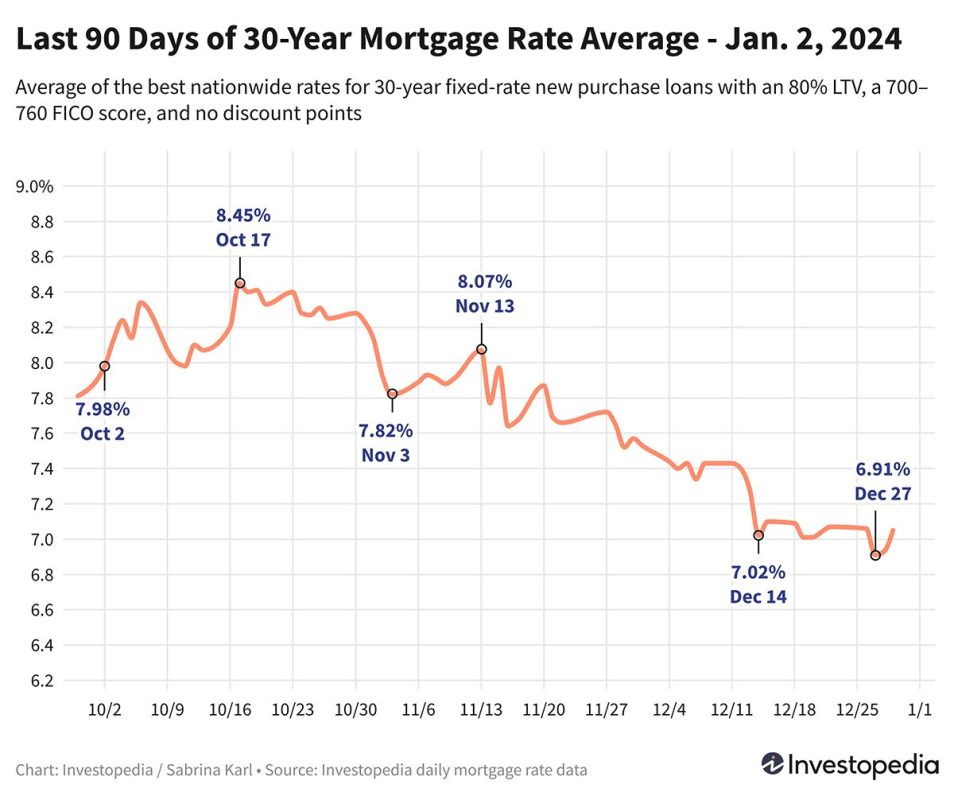

Learn how the upcoming release of the Consumer Price Index (CPI) report for December could potentially bring significant changes to mortgage rates. The Impact of the Consumer Price Index Report on Mortgage Rates The Consumer Price Index (CPI) report for December is set to be released, and it has the potential to bring significant changes […]

The Federal Reserve has decided to maintain its key interest rate, signaling its efforts to control inflation. Meanwhile, mortgage applications have declined due to rising mortgage rates. Federal Reserve Holds Interest Rates Steady The Federal Reserve has made the decision to maintain its key interest rate at a range of 5.25% to 5.50%. This move […]

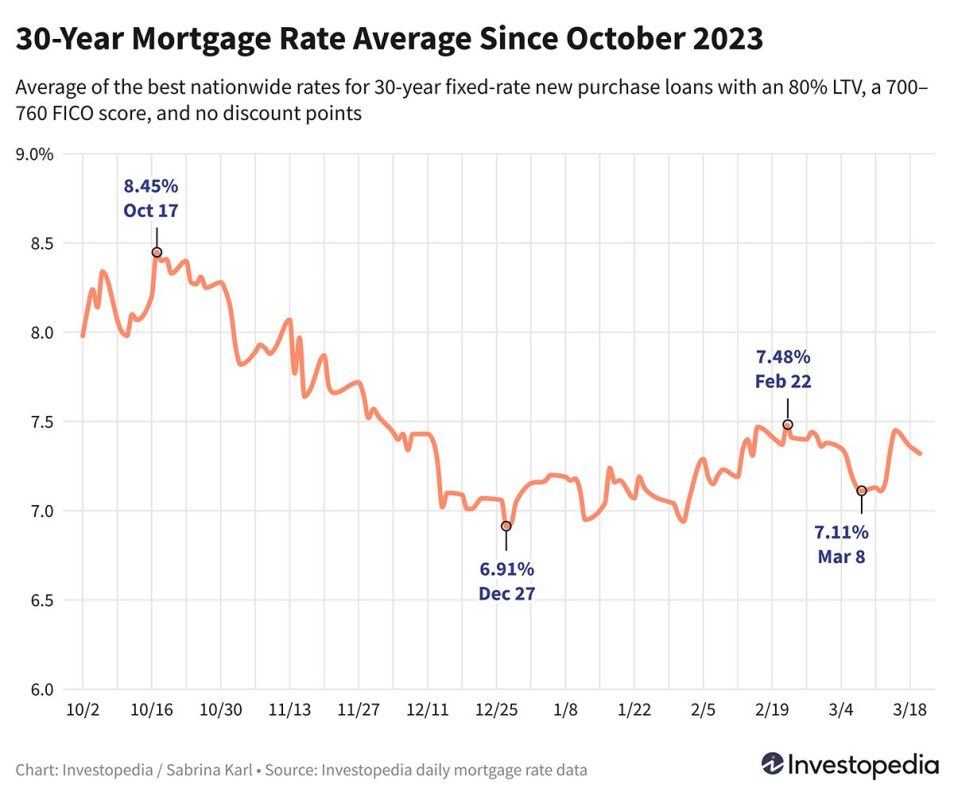

Mortgage rates have remained steady around 7%, with a slight increase in the past week. This has led to an uptick in mortgage applications, particularly from first-time homebuyers. Mortgage Rates Remain Steady Around 7%: An Analysis by Liam O’Connor Mortgage rates have remained relatively stable around 7%, with a slight increase in the past week, […]

Get the latest updates on mortgage rates and discover how they are impacting borrowers. Find out the average rates for different loan types and learn how to shop around for the best rates. Understanding Mortgage Rates: What Borrowers Need to Know When it comes to obtaining a mortgage, one of the most important factors to […]

Stay updated on the latest mortgage interest rates and trends. Find out if rates are dropping and how you can secure the best rate for your home loan. Latest Mortgage Interest Rates: Are Rates Dropping? As the mortgage market continues to fluctuate, many borrowers are wondering if mortgage interest rates are dropping. In this article, […]

Explore why waiting for mortgage rates to fall may not be the best strategy when buying a home. Learn about the potential consequences of delaying your home purchase and why experts advise against it. Why Waiting for Mortgage Rates to Fall May Not Be the Best Strategy When it comes to buying a new home, […]

Mortgage rates remain stable at around 7% this week, with a slight increase in the 30-year fixed-rate mortgage. However, there is good news as mortgage applications have seen an uptick after a six-week decline, indicating a positive sign for the upcoming spring buying season. Steady Mortgage Rates at 7% Signal Stability in the Market Mortgage […]

Discover the latest mortgage rate trends and find the best option for your specific needs. Compare rates from multiple lenders and secure a more affordable loan. Current Mortgage Rate Trends Mortgage rates continue to decline, offering potential homeowners and those looking to refinance an opportunity to secure a more affordable loan. After experiencing a slight […]

Mortgage rates have reached their lowest point since May, dropping to 6.62% following the Federal Reserve’s decision to keep interest rates unchanged in December. Experts predict further rate cuts next year, potentially improving housing affordability. Mortgage Rates Drop to Lowest Point Since May, Sparking Hope for Increased Housing Affordability Mortgage rates have reached their lowest […]

Discover the best affordable dining options in Birmingham with food blogger Simon Carlo’s recommendations. From authentic Sichuan cuisine at Yikouchi to Cantonese delights at WokChi and flavorful dishes at Shababs, these cheap eats won’t break the bank. Yikouchi – Authentic Sichuan Cuisine Discover the authentic flavors of Sichuan cuisine at Yikouchi, a hidden gem recommended […]

Find the latest mortgage interest rates for 30-year fixed, 15-year fixed, and 5/1 ARM loans. Make informed decisions about purchasing or refinancing your home with the most current rates. Current Mortgage Rates: Updated Daily from Bankrate Looking for the most current mortgage rates to help you make informed decisions about purchasing or refinancing your home? […]

Mortgage rates have dropped to their lowest levels since May 2023, but the upcoming jobs report on Friday could potentially impact rates. Depending on the job count, rates could remain low, reach new lows, or experience upward pressure. Mortgage Rates Reach 8-Month Lows: An Analysis by Liam O’Connor Mortgage rates have recently hit their lowest […]

Find out the average mortgage rates for different loan terms as of March 19, 2024, and understand the importance of APR in determining total loan costs. Understanding Mortgage Rates When looking at mortgage rates, it’s important to consider the annual percentage rate (APR). The APR includes both the mortgage interest rate and the lender fees, […]

Stay informed about the latest mortgage interest rates and explore different loan terms and types to find the best fit for your financial situation. Understanding Mortgage Interest Rates Mortgage interest rates play a crucial role in the homebuying process. As a knowledgeable and experienced mortgage broker, I understand the importance of staying informed about the […]

A recent study shows that home prices are rising faster than inflation, making it harder for people to afford homes. The study also highlights the impact of inflation misjudgment and the strong revenue growth in the services sector. Mortgage applications surge as interest rates dip. Soaring Home Prices Outpacing Inflation: A Concerning Trend A recent […]

Mortgage rates have remained steady, but the upcoming jobs report has the potential to cause movement in the market. Impact of the Upcoming Jobs Report on Mortgage Rates Mortgage rates have remained steady in recent weeks, but the upcoming jobs report has the potential to cause movement in the market. As a knowledgeable and experienced […]

Inflation in the UK fell to 3.4% in February, increasing the possibility of interest rate cuts by the Bank of England. While this brings optimism for homeowners, experts caution against expecting an immediate decrease in rates. Inflation Drops to 3.4% in February, Raising Hopes for Interest Rate Reduction Inflation in the United Kingdom fell faster […]

The latest inflation report has had a significant impact on mortgage rates, leading to a correction in the bond and rate market. With inflation on the rise again, borrowers and lenders need to stay informed and prepared for potential rate adjustments. Impact of the Latest Inflation Report on Mortgage Rates The latest inflation report has […]

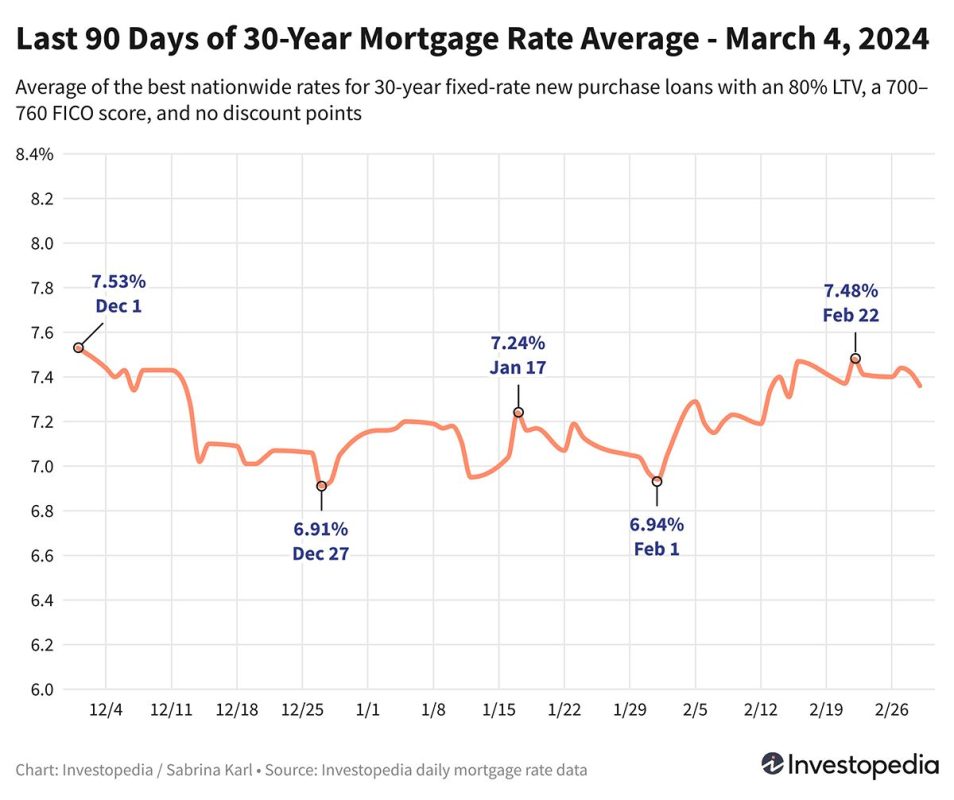

Discover the recent fluctuations in mortgage rates in the United States. Learn about the factors influencing these rates and how they compare to previous months. Recent Fluctuations in Mortgage Rates Mortgage rates in the United States have experienced some fluctuations recently. After a brief decrease, 30-year new purchase rates have risen slightly, reaching 7.38%, which […]

Discover the top 10 mortgage lenders in the United States based on their features, pros and cons. Find the best fit for your needs when purchasing a home. Guaranteed Rate: Streamlined Digital Mortgage Process Guaranteed Rate is a leading lender known for its digital mortgage process. Borrowers can complete the entire process online, making it […]

Considering the potential for rates to rise again, the historically low rates currently available, and the options that exist if rates do drop, it may be beneficial for many buyers to lock in a mortgage rate now. Why Locking in a Mortgage Rate Before the Fed’s March Meeting is a Wise Decision As the Federal […]

When it comes to borrowing money, there are various options available to individuals. Two common options are mortgages and pledges, both of which involve using an asset as collateral for the loan. However, these two options have significant differences that should be understood before making a decision. In this article, giamsathanhtrinh24h.vn and you will explore […]

The world of finance can be complex and overwhelming, especially when it comes to mortgages. With so many different terms, institutions, and regulations, it can be challenging to navigate through the process of obtaining a mortgage. One crucial player in this industry is the mortgage bank. In this article, giamsathanhtrinh24h.vn and you will dive into […]

Are you considering buying a home or currently paying off a mortgage? If so, understanding your monthly mortgage payments is crucial in managing your finances. A mortgage payment calculator is a powerful tool that can help you estimate your monthly expenses and make informed decisions about your home purchase. In this comprehensive guide, giamsathanhtrinh24h.vn and […]