Discover the latest mortgage rate trends and find the best option for your specific needs. Compare rates from multiple lenders and secure a more affordable loan.

Current Mortgage Rate Trends

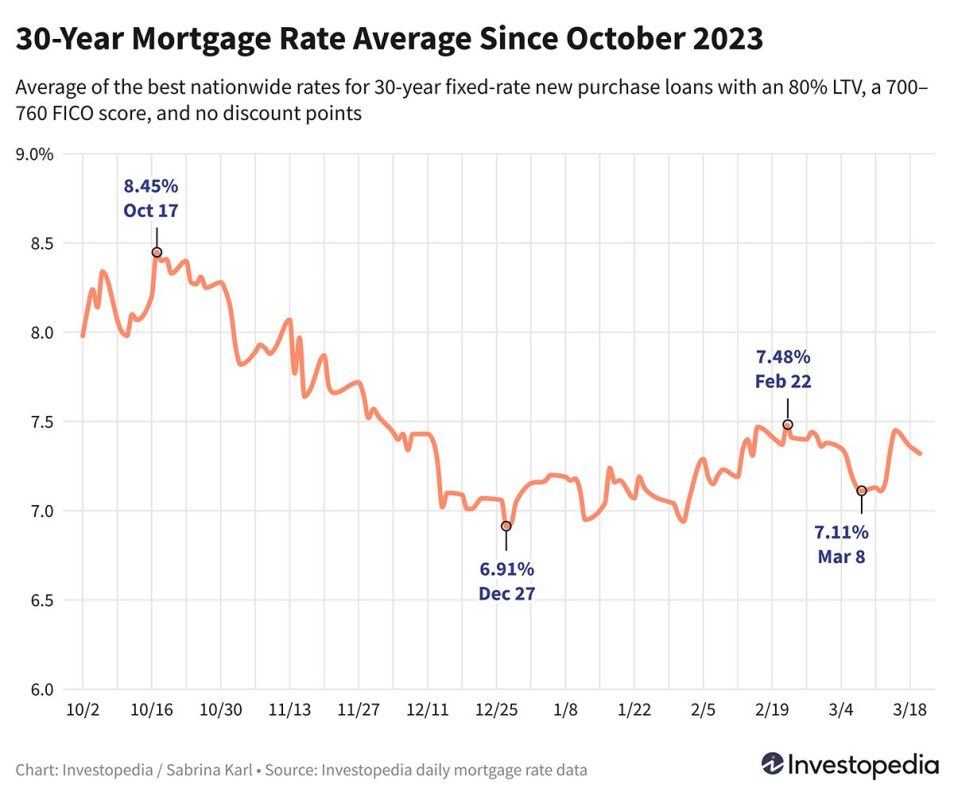

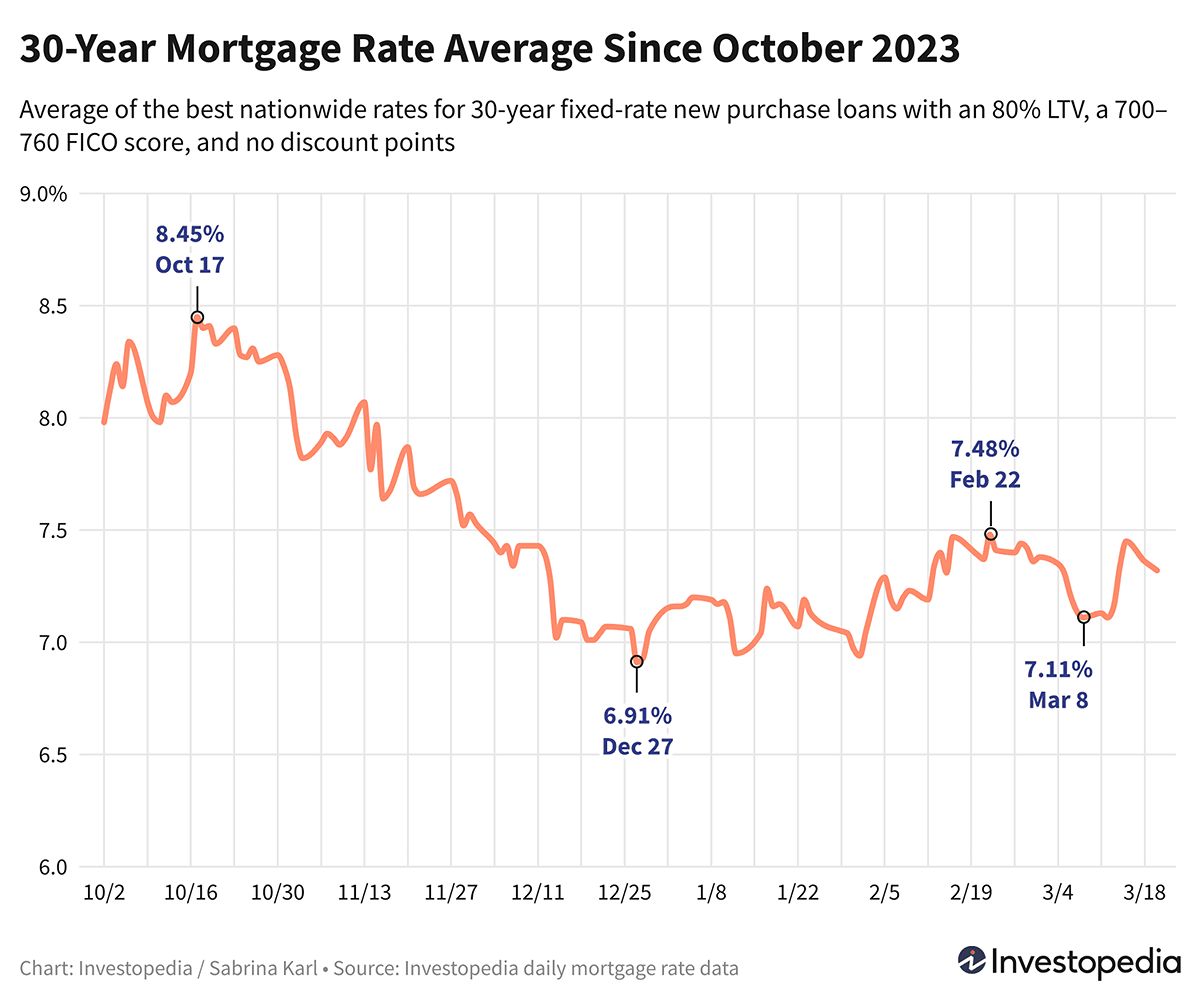

Mortgage rates continue to decline, offering potential homeowners and those looking to refinance an opportunity to secure a more affordable loan. After experiencing a slight increase last week, rates on 30-year mortgages have dropped by over a tenth of a percent earlier this week. This brings the average rate to 7.32%, offsetting some of the previous week’s climb to the mid-7% range. Other loan types, both for new purchases and refinancing, have also seen decreases or remained steady.

( Credit to: Investopedia )

It’s important to note that rates can vary significantly across lenders. Therefore, it is always advisable to shop around and compare rates regularly to find the best mortgage option for your specific needs.

National Averages for Different Loan Types

Here are the national averages of lenders’ best rates for different loan types:

- 30-Year Fixed: 7.32% for new purchases, 7.77% for refinancing

- FHA 30-Year Fixed: 7.33% for new purchases, 7.78% for refinancing

- Jumbo 30-Year Fixed: 6.95% for new purchases and refinancing

- 15-Year Fixed: 6.66% for new purchases, 6.85% for refinancing

- 5/6 ARM: 7.74% for new purchases, 7.76% for refinancing

It is worth noting that these rates are based on national averages and may not directly align with teaser rates advertised online. Teaser rates are often cherry-picked to showcase the most attractive options, which may involve paying points in advance or assuming an ultra-high credit score. The mortgage rate you ultimately secure will depend on various factors such as your credit score, income, and loan size.

State-Level Variations in Mortgage Rates

The lowest mortgage rates available can vary by state due to state-level variations in credit scores, average loan types, and sizes. The states with the cheapest 30-year new purchase rates are Mississippi, Louisiana, Hawaii, Iowa, and Vermont. On the other hand, Minnesota, Arizona, Idaho, Nevada, Washington, and Oregon have the most expensive rates.

Factors Influencing Mortgage Rates

Mortgage rates are influenced by a combination of macroeconomic and industry factors. These include the level and direction of the bond market, especially 10-year Treasury yields, the Federal Reserve’s monetary policy, and competition among mortgage lenders and loan types. Fluctuations in rates can be attributed to a mix of these factors, making it challenging to pinpoint a single cause.

In recent years, the Federal Reserve’s bond-buying policies and rate adjustments have played a significant role in mortgage rate movements. The Fed’s bond purchases aimed to address economic pressures caused by the pandemic. However, since November 2021, the Fed has been tapering its bond purchases, leading to a reduction in net purchases to zero by March 2022.

Between November 2021 and July 2023, the Fed aggressively raised the federal funds rate in response to high inflation. While the fed funds rate can indirectly influence mortgage rates, the two can move in opposite directions. The rapid rate increases by the Fed have had a significant impact on mortgage rates over the past two years.

Currently, the Fed has maintained the federal funds rate at its current level since July. The Fed’s “dot plot” forecast suggests a potential reduction in rates in 2024, with the median expectation of three rate decreases totaling 0.75 percentage points by the end of the year. The dot plot also indicates similar expected rate cuts in 2025 and 2026.

It’s important to remember that mortgage rates can fluctuate, and individual lenders may offer different rates based on various factors. Therefore, it’s crucial to compare rates from multiple lenders to find the best mortgage option for your specific circumstances.