The latest inflation report has had a significant impact on mortgage rates, leading to a correction in the bond and rate market. With inflation on the rise again, borrowers and lenders need to stay informed and prepared for potential rate adjustments.

Impact of the Latest Inflation Report on Mortgage Rates

The latest inflation report has had a significant impact on mortgage rates, causing a correction in the bond and rate market. This has led to a shift in rates from their best levels in 8 months to the worst levels in over a month in just 2 days. The focus on the Consumer Price Index (CPI) in recent times has been justified, as it is a key indicator of inflation and holds the most influence in the market.

( Credit to: Mortgagenewsdaily )

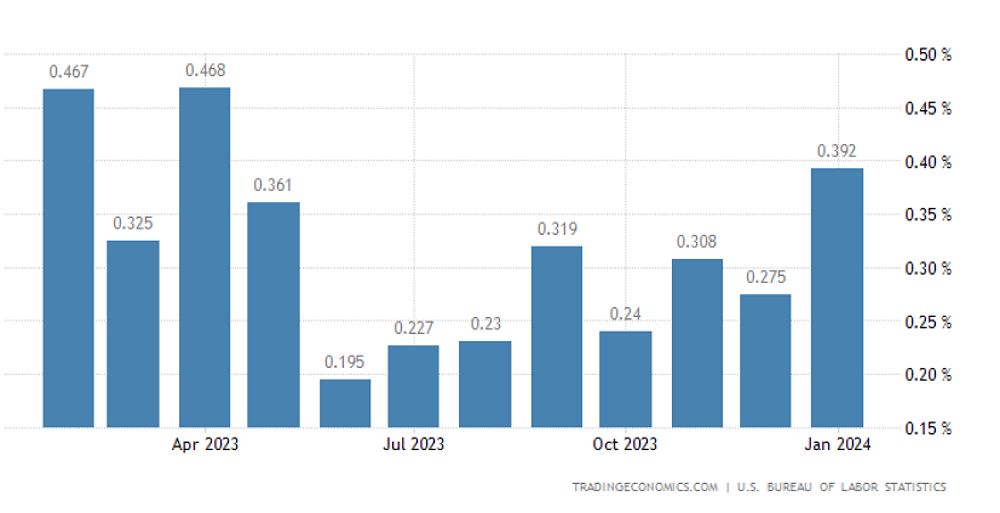

Today’s CPI data had even more significant consequences. The report showed that core month-over-month inflation rose to 0.4%, surpassing market expectations of a steady rate. This small change in the inflation rate suggests a shift in the momentum of inflation, which had been cooling since September but is now rising again towards early 2023 levels. As a result, the bond market, which directly affects mortgage rates, reacted swiftly and forcefully to this news.

( Credit to: Mortgagenewsdaily )

Bond prices continued to decline throughout the day, prompting many mortgage lenders to increase their rates once or even twice. This has pushed the average 30-year fixed-rate mortgage well into the 7% range, after being in the high 6% range just yesterday. It is clear that the latest CPI report has reaffirmed the importance of monitoring inflation and its impact on mortgage rates. With inflation seemingly on the rise again, it is crucial for borrowers and lenders to stay informed and prepared for potential rate adjustments in the future.

Monitoring Inflation and Preparing for Rate Adjustments

With the latest CPI report indicating a potential rise in inflation, it is essential for borrowers and lenders to closely monitor inflation trends. Inflation has been the primary driver behind the rise in mortgage rates over the past couple of years, and any shifts in inflation momentum can have a significant impact on rates.

As borrowers, it is important to stay informed about inflation data and how it may affect mortgage rates. This can help in making informed decisions about when to lock in a mortgage rate or consider refinancing options. Working closely with a mortgage broker or financial advisor who has experience in the mortgage industry can provide valuable insights and guidance.

Lenders also need to be prepared for potential rate adjustments. With inflation potentially on the rise again, lenders may need to adjust their rates to account for changing market conditions. This requires staying up-to-date with inflation reports and market trends, as well as analyzing the impact on their mortgage portfolios.

In conclusion, the latest inflation report has highlighted the importance of monitoring inflation and its impact on mortgage rates. With inflation potentially on the rise again, both borrowers and lenders need to stay informed and prepared for potential rate adjustments in the future.