Discover the recent fluctuations in mortgage rates in the United States. Learn about the factors influencing these rates and how they compare to previous months.

Recent Fluctuations in Mortgage Rates

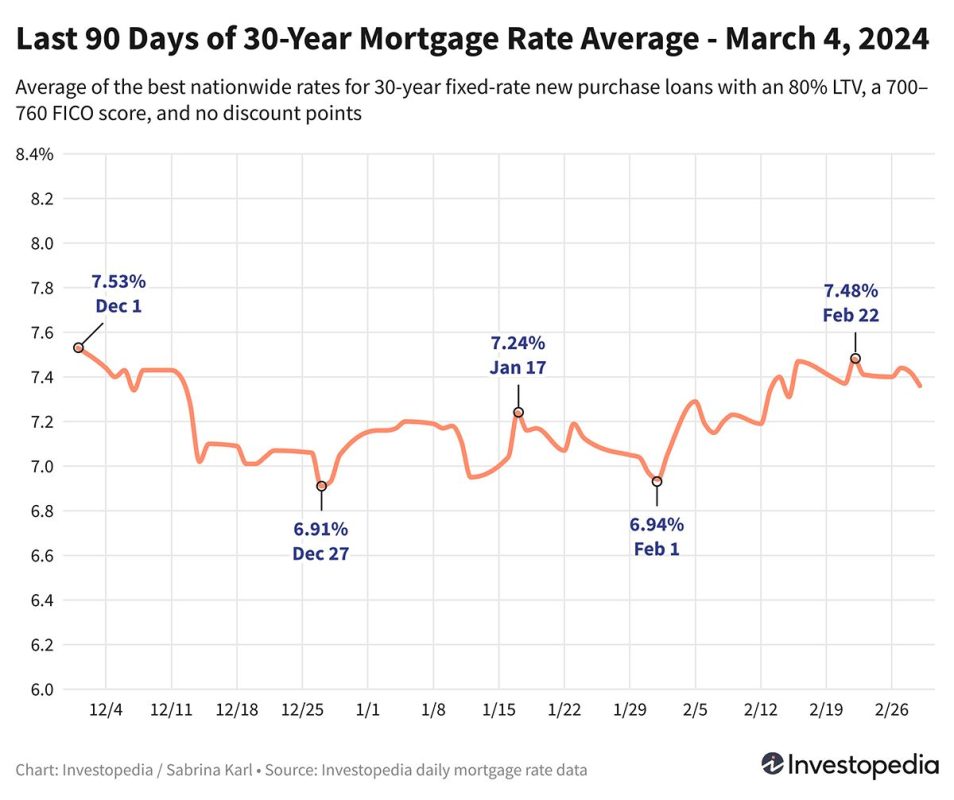

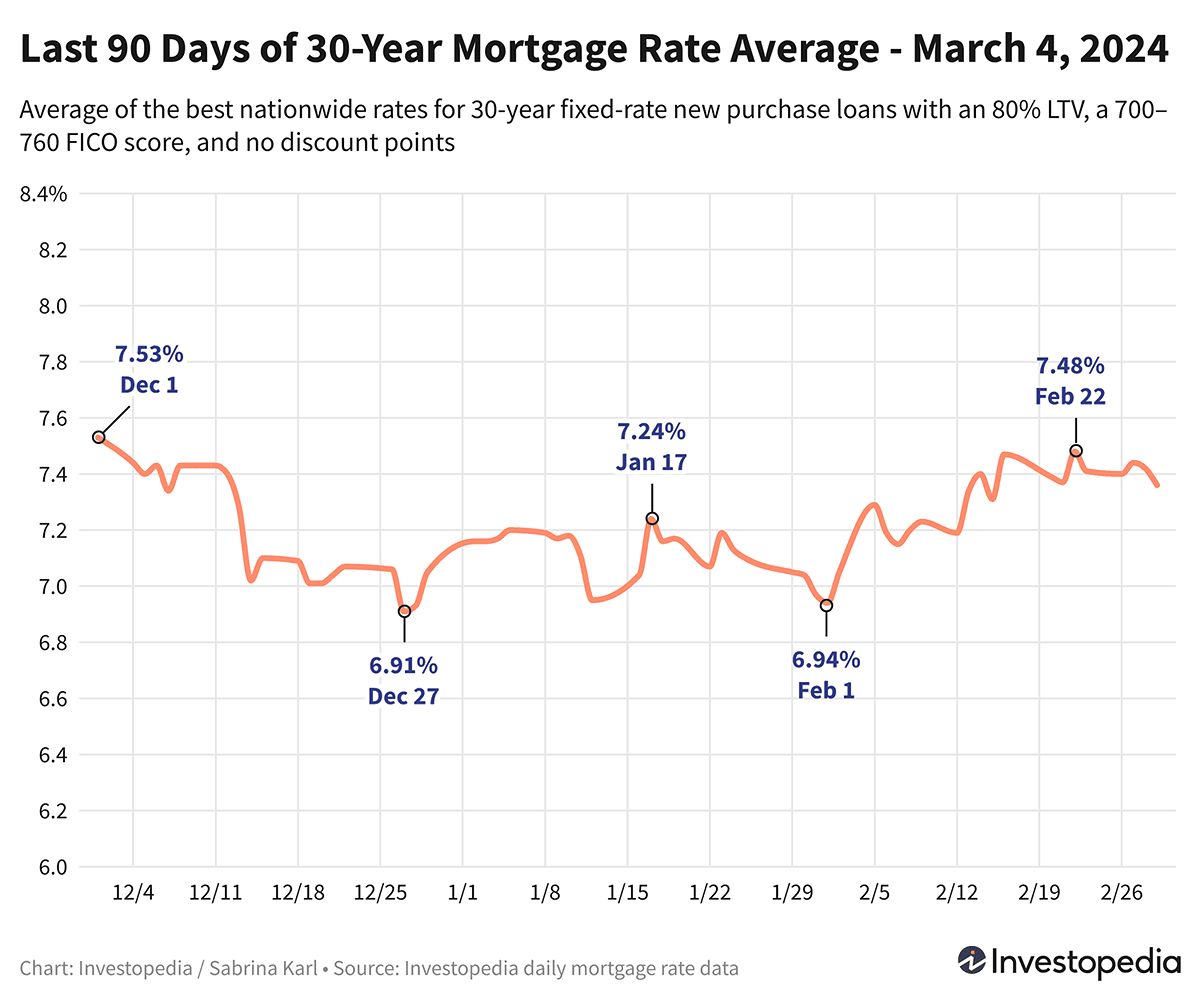

Mortgage rates in the United States have experienced some fluctuations recently. After a brief decrease, 30-year new purchase rates have risen slightly, reaching 7.38%, which is just above the lowest level observed since February 15. However, these rates are still higher compared to earlier this year when they dipped into the 6% range. In October, the 30-year average hit a record high of 8.45%.

( Credit to: Investopedia )

Similarly, rates on 15-year new purchase loans have also increased slightly, reaching an average of 6.76%. This is significantly higher than the 6.10% low seen at the end of last year but lower than the peak of 7.59% reached in October. Jumbo 30-year rates, on the other hand, have remained steady at 6.82% after reaching a high of 7.52% in October.

Refinancing Rates and Changes

Refinancing rates have shown minor movements, with the 30-year refi average dropping by 13 basis points. The spread between 30-year new purchase and refi rates has narrowed to 31 basis points. Other refi rates, including 15-year refi and jumbo 30-year refi, have remained relatively unchanged. The only significant change was observed in 20-year refi loans, which saw an increase of 18 basis points.

Freddie Mac’s Weekly Average

Freddie Mac’s weekly average of 30-year mortgage rates has also increased by 4 basis points, reaching 6.94%. This average differs from other sources as it blends rates from the previous five days. However, the rates included in Freddie Mac’s survey may involve discount points, while other averages only consider zero-point loans.

Factors Influencing Mortgage Rates

Mortgage rates are influenced by various factors, including the bond market, the Federal Reserve’s monetary policy, and competition among lenders. The Federal Reserve’s bond-buying policy has played a significant role in keeping mortgage rates low, but as they taper their purchases, rates have started to rise. The Fed has also raised the federal funds rate to combat inflation, indirectly impacting mortgage rates. However, the Fed has recently signaled a pause in rate hikes and even the possibility of rate cuts in the future.

Conclusion

In conclusion, mortgage rates in the United States have seen some slight increases recently. While rates are still higher compared to earlier this year, they have come down significantly from the historic highs reached in October. It is important for borrowers to stay informed about current rates and consider shopping around for the best mortgage option.