The world of finance can be complex and overwhelming, especially when it comes to mortgages. With so many different terms, institutions, and regulations, it can be challenging to navigate through the process of obtaining a mortgage. One crucial player in this industry is the mortgage bank. In this article, giamsathanhtrinh24h.vn and you will dive into the world of mortgage banks, exploring their role, functions, and impact on the housing market.

Mortgage Bank: What is it and How Does it Work?

A mortgage bank is a financial institution that specializes in providing loans for purchasing or refinancing real estate properties. These loans are secured by the property itself, meaning that if the borrower fails to make payments, the bank can foreclose on the property to recoup its losses. Mortgage banks differ from traditional banks in that they do not offer other banking services such as checking or savings accounts. Instead, their sole focus is on providing mortgage loans.

Mortgage banks work by using funds from investors or their own capital to provide loans to borrowers. They then sell these loans to government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac, who then package them into mortgage-backed securities (MBS). This process allows mortgage banks to replenish their funds and continue issuing loans to new borrowers.

The Role of Mortgage Banks in the Housing Market

Mortgage banks play a significant role in the housing market, as they are responsible for providing the majority of home loans in the United States. According to the Mortgage Bankers Association (MBA), mortgage banks originated 68% of all residential loans in 2020. This makes them a crucial player in the housing market, as their lending practices can have a significant impact on the overall economy.

One of the main advantages of mortgage banks is their ability to offer a wide range of loan products to borrowers. Unlike traditional banks, which may have stricter lending criteria, mortgage banks can be more flexible in their underwriting process. This allows them to cater to a broader range of borrowers, including those with less-than-perfect credit scores or unconventional income sources.

Moreover, mortgage banks also play a vital role in providing liquidity to the housing market. By selling their loans to GSEs, they free up capital to issue new loans, ensuring that there is a constant flow of funds available for homebuyers. This helps to keep interest rates competitive and makes homeownership more accessible for many individuals and families.

Mortgage Bankers Association: The Voice of the Industry

The Mortgage Bankers Association (MBA) is the leading trade association representing the real estate finance industry. Founded in 1914, the MBA has over 2,200 member companies, including mortgage banks, commercial banks, and other financial institutions. Its mission is to promote fair and ethical lending practices, advocate for policies that benefit the industry, and provide education and networking opportunities for its members.

The Annual Mortgage Bankers Association Conference

One of the most significant events organized by the MBA is its annual conference, which brings together industry leaders, policymakers, and experts to discuss the latest trends and challenges facing the mortgage banking industry. The conference features keynote speakers, panel discussions, and networking opportunities, making it a must-attend event for anyone involved in the mortgage industry.

The conference also includes an exhibition hall where vendors showcase their products and services related to the mortgage industry. This provides attendees with the opportunity to learn about new technologies, network with potential business partners, and stay updated on the latest industry developments.

The Impact of the MBA on the Mortgage Banking Industry

The MBA plays a crucial role in shaping the mortgage banking industry through its advocacy efforts. It works closely with policymakers and regulators to ensure that the interests of its members are represented and that any new regulations are fair and reasonable. The MBA also provides its members with valuable resources and tools to help them navigate the ever-changing landscape of the mortgage industry.

Moreover, the MBA is committed to promoting diversity and inclusion within the industry. It has established a Diversity and Inclusion Committee that works to increase representation and opportunities for underrepresented groups in the mortgage banking industry. This not only benefits the industry as a whole but also helps to create a more inclusive and equitable society.

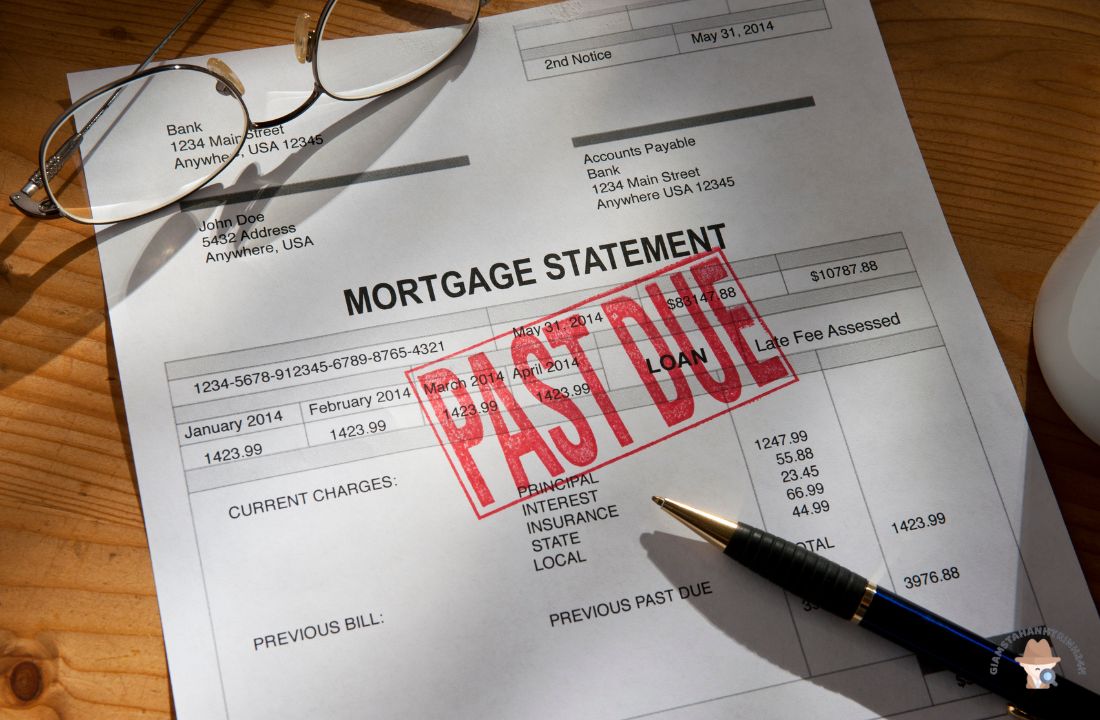

Mortgage Bank Statements: What You Need to Know

Once you have obtained a mortgage loan from a mortgage bank, you will receive regular statements outlining your loan balance, interest rate, and payment due dates. These statements are essential for keeping track of your loan and ensuring that you are making timely payments. Here’s what you need to know about mortgage bank statements:

- Frequency: Most mortgage banks send out statements on a monthly basis, although some may do so quarterly or semi-annually.

- Contents: Your mortgage bank statement will include information such as your loan number, current balance, interest rate, and any escrow payments for taxes and insurance. It will also show how much of your payment went towards principal and interest.

- Payment Options: Your statement will also provide details on how to make your mortgage payments, including online options, mail-in payments, or automatic withdrawals.

- Reviewing Your Statement: It is crucial to review your mortgage bank statement each month to ensure that all the information is accurate. If you notice any discrepancies, contact your mortgage bank immediately to address the issue.

Mortgage Bankers Field Services: Protecting Lenders’ Interests

Mortgage bankers field services (MBFS) are companies that provide property inspection and preservation services for mortgage banks and other lenders. These services are essential for protecting the lender’s interests in the event of default by the borrower. Here’s a closer look at what MBFS does and why it is crucial for mortgage banks.

The Role of MBFS

MBFS companies work closely with mortgage banks to ensure that properties securing their loans are well-maintained and in good condition. This includes conducting regular inspections to check for any damages or potential issues, as well as performing necessary repairs or maintenance tasks. In the event of a foreclosure, MBFS companies also handle the process of securing and maintaining the property until it is sold.

The Importance of MBFS for Mortgage Banks

MBFS plays a crucial role in protecting mortgage banks’ interests by ensuring that the properties securing their loans are well-maintained. This helps to preserve the value of the property and reduces the risk of financial losses for the lender. Moreover, MBFS companies can also help to expedite the foreclosure process by providing accurate and timely information about the property’s condition.

Mortgage Bank Rates: Understanding How They Work

Mortgage bank rates refer to the interest rate charged on a mortgage loan issued by a mortgage bank. These rates can vary depending on several factors, including the borrower’s credit score, loan term, and the current state of the economy. Here’s what you need to know about mortgage bank rates:

- Fixed vs. Adjustable Rates: Mortgage bank rates can be either fixed or adjustable. A fixed-rate mortgage means that the interest rate remains the same throughout the life of the loan, while an adjustable-rate mortgage (ARM) has a variable interest rate that can change over time.

- Factors That Affect Rates: Some of the main factors that can impact mortgage bank rates include inflation, economic growth, and the Federal Reserve’s monetary policy. Additionally, your credit score and the type of loan you choose can also affect the interest rate you receive.

- Locking in Your Rate: When applying for a mortgage loan, borrowers have the option to lock in their interest rate for a specific period. This means that even if rates increase before closing, the borrower will still receive the lower rate they locked in.

- Shopping Around for Rates: It is essential to shop around and compare rates from different mortgage banks to ensure that you are getting the best deal. Even a small difference in interest rates can result in significant savings over the life of the loan.

Conclusion

In conclusion, mortgage banks play a crucial role in the housing market, providing a steady flow of funds for homebuyers and promoting homeownership. They also offer a wide range of loan products and personalized service, making them an attractive option for borrowers. However, it is essential to understand the potential disadvantages of working with a mortgage bank and to review your statements regularly to ensure accuracy.

The Mortgage Bankers Association serves as the voice of the industry, advocating for fair and ethical lending practices and promoting diversity and inclusion within the industry. Mortgage bankers field services are also vital for protecting lenders’ interests and preserving the value of properties securing their loans. Finally, understanding how mortgage bank rates work can help borrowers make informed decisions when obtaining a mortgage loan.

giamsathanhtrinh24h.vn