Emergencies can strike at any time, leaving you with unexpected expenses that you may not be able to afford. Whether it’s a medical emergency, car repair, or unexpected job loss, these situations can quickly drain your savings and put you in a financial bind. In times like these, a loan can provide the necessary funds to help you get back on your feet. However, with so many different types of loans available, it can be overwhelming to know which one is right for your specific situation. In this guide, giamsathanhtrinh24h.vn and you will discuss the various options for emergency loans and how to choose the best one for your needs.

Loans Emergency

When it comes to emergency loans, there are several options available. Each type of loan has its own terms and conditions, so it’s important to understand the differences before making a decision. Here are some of the most common types of emergency loans:

Personal Loans

Personal loans are unsecured loans that can be used for a variety of purposes, including emergencies. They are typically offered by banks, credit unions, and online lenders. The amount you can borrow and the interest rate will depend on your credit score and income. Personal loans usually have fixed interest rates and monthly payments, making them easier to budget for. However, they may have higher interest rates than secured loans and require a good credit score to qualify.

Personal Loans for Bad Credit

If you have a low credit score, it may be more difficult to qualify for a personal loan. However, there are still options available. Some lenders specialize in offering personal loans for those with bad credit. These loans may come with higher interest rates and fees, but they can still provide the necessary funds in an emergency situation.

Personal Loans with Assistance Programs

In some cases, you may be able to find personal loans with assistance programs. These programs are designed to help those who are struggling financially and may offer lower interest rates or more flexible repayment options. It’s worth researching if there are any assistance programs available in your area before taking out a personal loan.

Payday Loans

Payday loans are small, short-term loans that are typically due on your next payday. They are usually offered by storefront lenders or online lenders. The amount you can borrow is usually limited to a few hundred dollars, and the interest rates and fees are extremely high. In fact, the average annual percentage rate (APR) for a payday loan is around 400%. These loans should only be used as a last resort, as they can quickly lead to a cycle of debt if not repaid on time.

No Credit Check Payday Loans

One of the main appeals of payday loans is that they often do not require a credit check. This means that even if you have bad credit, you may still be able to qualify for a payday loan. However, this also means that the lender is taking on a higher risk, which is why the interest rates and fees are so high.

Online Payday Loans

With the rise of online lending, it’s now possible to apply for a payday loan from the comfort of your own home. Online payday loans may have slightly lower interest rates and fees compared to storefront lenders, but they still come with high costs. It’s important to thoroughly research the lender and read reviews before applying for an online payday loan.

Title Loans

Title loans are secured loans that are backed by the title to your car. They are usually offered by storefront lenders and online lenders. The amount you can borrow is based on the value of your car, and the interest rates are typically lower than payday loans. However, if you default on the loan, the lender has the right to repossess your car. This makes title loans a risky option, especially if you rely on your car for transportation.

Guaranteed Approval Title Loans

Some lenders may advertise guaranteed approval for title loans, regardless of your credit score. However, this is often a marketing tactic and does not guarantee that you will be approved for the loan. It’s important to carefully read the terms and conditions and understand the risks before taking out a title loan.

Title Loans for Poor Credit

Similar to personal loans, there are lenders who specialize in offering title loans for those with poor credit. These loans may come with higher interest rates, but they can still provide the necessary funds in an emergency situation. It’s important to carefully consider the risks and make sure you can afford the loan before taking it out.

Credit Card Advances

If you have a credit card, you may be able to get a cash advance against your credit limit. This allows you to borrow money from your credit card and repay it over time. However, credit card advances usually come with high interest rates and fees, and they should only be used as a last resort. It’s also important to note that using a credit card advance will increase your credit utilization ratio, which can negatively impact your credit score.

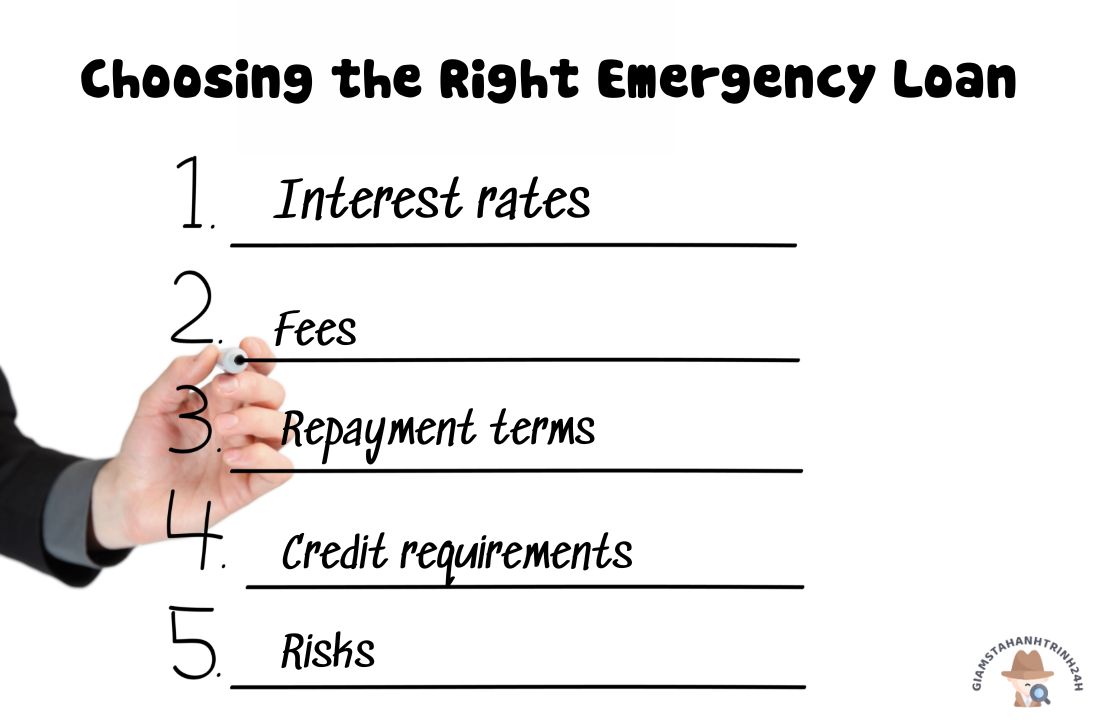

Choosing the Right Emergency Loan

When it comes to choosing the right emergency loan, there are several factors to consider. Here are some key points to keep in mind:

- Interest rates: The interest rate will determine how much you will pay back in addition to the amount borrowed. Generally, the lower the interest rate, the better.

- Fees: Some loans come with additional fees, such as origination fees or prepayment penalties. Make sure to read the fine print and understand all the fees associated with the loan.

- Repayment terms: Consider how long you will have to repay the loan and whether the monthly payments fit within your budget.

- Credit requirements: Some loans, such as personal loans, may require a good credit score to qualify. If you have bad credit, you may need to look for alternative options.

- Risks: Consider the risks associated with each type of loan and whether you are comfortable taking on that risk.

It’s also important to carefully read the terms and conditions of any loan before signing on the dotted line. Make sure you understand all the details and ask questions if anything is unclear.

Conclusion

In times of emergency, a loan can provide the necessary funds to help you get back on your feet. However, it’s important to carefully consider all your options and choose the right loan for your specific situation. Personal loans, payday loans, title loans, and credit card advances all have their own unique terms and conditions, so it’s important to understand the differences before making a decision. Remember to always borrow responsibly and only take out a loan if you can afford to repay it.

giamsathanhtrinh24h.vn