Get the latest updates on mortgage rates and discover how they are impacting borrowers. Find out the average rates for different loan types and learn how to shop around for the best rates.

Understanding Mortgage Rates: What Borrowers Need to Know

When it comes to obtaining a mortgage, one of the most important factors to consider is the interest rate. Mortgage rates can have a significant impact on the overall cost of homeownership, making it crucial for borrowers to stay informed about any fluctuations. In this article, we will explore the current state of mortgage rates and provide valuable insights for borrowers.

( Credit to: Investopedia )

As an experienced mortgage broker with over 20 years in the industry, I have witnessed the ebb and flow of interest rates. My goal is to provide you with accurate and insightful information to help you make informed decisions about your mortgage.

Average Mortgage Rates for Different Loan Types

When comparing mortgage rates, it’s essential to consider the different loan types available. Here are the current national averages for various loan types:

- 30-Year Fixed: 7.05%

- FHA 30-Year Fixed: 6.95%

- Jumbo 30-Year Fixed: 6.31%

- 15-Year Fixed: 6.25%

- 5/6 ARM: 7.51%

These rates are based on the lowest rates offered by top lenders in the country, assuming an 80% loan-to-value ratio and a FICO credit score of 700-760. It’s important to note that individual lenders may offer slightly different rates, so it’s always wise to shop around and compare.

Recent Trends: Mortgage Rates on the Rise

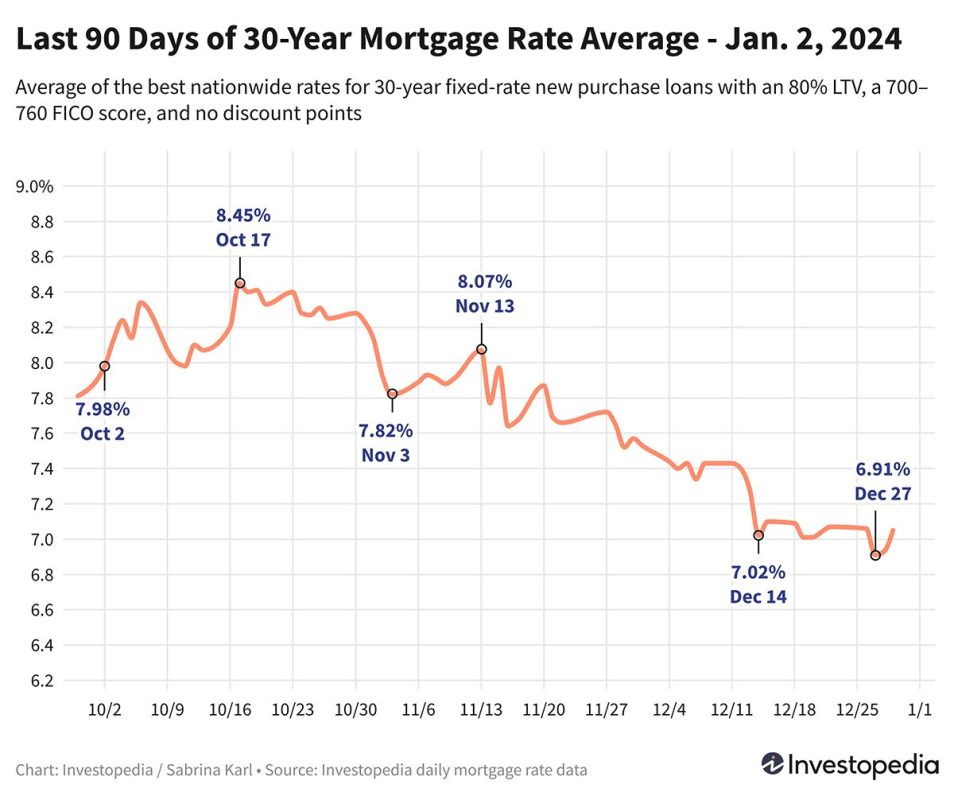

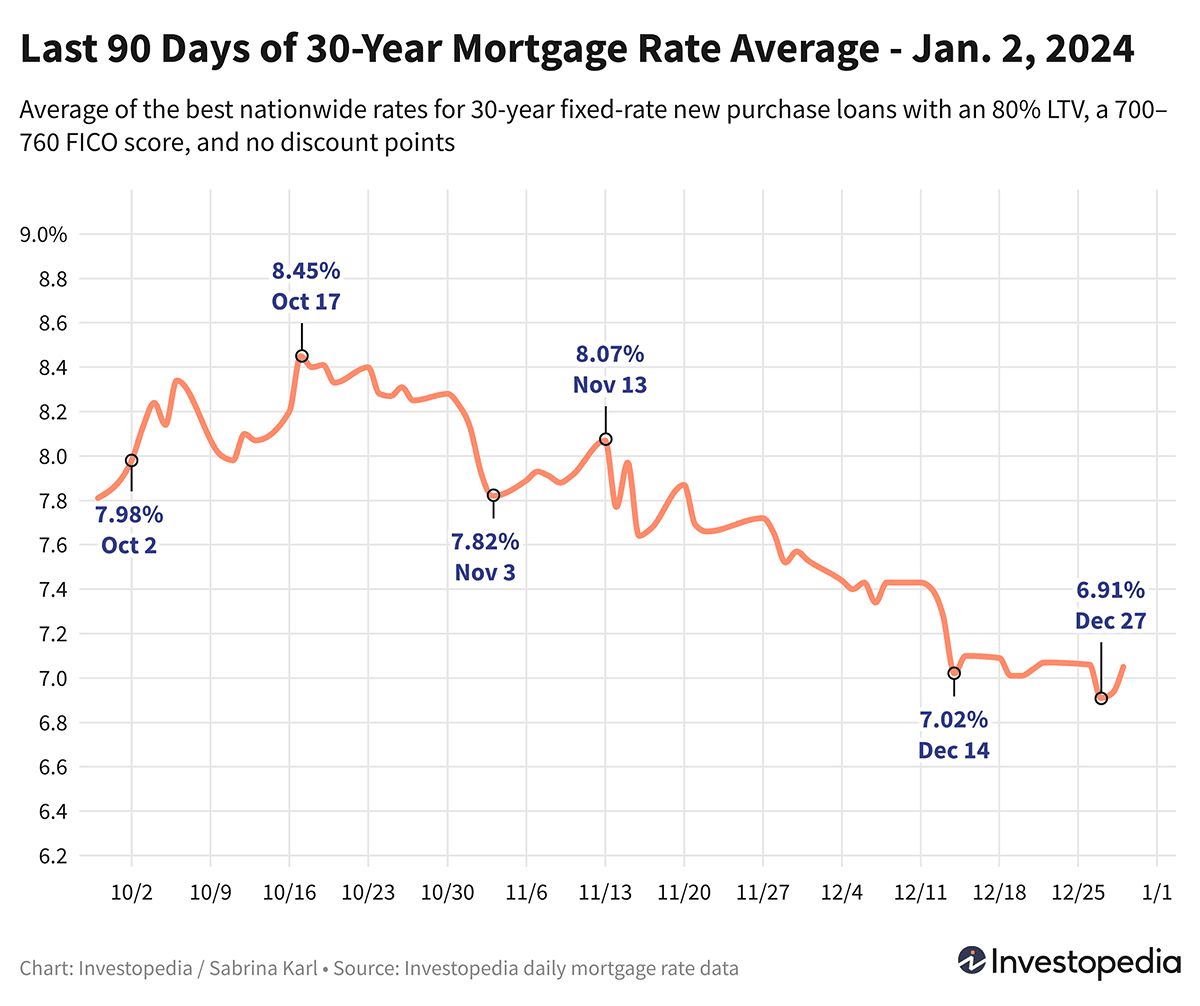

In recent weeks, we have seen mortgage rates experience some fluctuations. After reaching their lowest levels in seven months, the average 30-year mortgage rate saw a slight increase, ending the week at 7.05%. Similarly, other mortgage averages also saw a slight uptick.

While these increases may seem concerning, it’s important to keep them in perspective. The current rates are still within the cheapest range since mid-May and significantly lower than the peak rate of 8.45% recorded in October, which was the highest in 23 years.

However, it’s worth noting that mortgage rates can vary depending on various factors, such as the state of originations and individual lenders’ risk management strategies. For example, states like Mississippi, Vermont, Delaware, Iowa, and Louisiana currently have the cheapest 30-year new purchase rates, while Georgia, Nevada, Washington, Idaho, and Minnesota have the most expensive averages.

Factors Influencing Mortgage Rates

The mortgage market is influenced by a complex interplay of macroeconomic and industry factors. Some key factors that can impact mortgage rates include:

- The level and direction of the bond market, especially 10-year Treasury yields

- The Federal Reserve’s monetary policy

- Competition among mortgage lenders and loan types

It’s important to note that attributing rate changes to a single factor can be challenging due to the multitude of influences. However, in recent times, the Federal Reserve’s bond-buying policy has kept mortgage rates relatively low. As the Fed tapers its bond purchases and raises the federal funds rate to combat high inflation, we may see an upward impact on mortgage rates.

Despite the recent rate increases, the Fed has indicated a possibility of rate cuts in the future if inflation does not decrease as projected. Their median expectation is for three rate cuts by the end of 2024. It’s crucial to stay updated on the Federal Reserve’s decisions and their potential impact on mortgage rates.

Tips for Borrowers: Shopping Around for the Best Rates

As a knowledgeable mortgage broker, I always advise borrowers to shop around and compare rates regularly when seeking a mortgage. Rates can vary significantly among lenders, so it’s essential to explore your options. Here are some tips to help you find the best mortgage rates:

- Research and compare rates from multiple lenders

- Consider different loan types and their associated rates

- Pay attention to your credit score and take steps to improve it if needed

- Consider working with a mortgage broker who can help you navigate the market

By taking the time to research and compare rates, you can ensure that you secure the most favorable mortgage terms for your specific needs and qualifications.

Conclusion: Staying Informed and Making Informed Decisions

Understanding mortgage rates is crucial for borrowers looking to finance their homes. By staying informed about the current state of mortgage rates, average rates for different loan types, and the factors that influence them, borrowers can make informed decisions that align with their financial goals.

As an experienced mortgage broker with over 20 years of industry experience, I am here to provide you with the insights and guidance you need to navigate the mortgage market. Remember to shop around, compare rates, and consider working with a professional to ensure you secure the best mortgage terms for your unique situation.